How AI Improves Financial Forecasting for Startups: Complete Guide

TL;DR

AI-powered financial forecasting uses machine learning algorithms to predict future cash flow, revenue, and expenses with 85-95% accuracy—far exceeding traditional spreadsheet models (60-70%). For startups, Automated forecasting reduces manual work by 80%, identifies financial risks weeks in advance, and provides CFO-level insights without requiring finance expertise. Modern platforms like Uniflow, Runway, and Finmark make this technology accessible to early-stage companies.

New to financial operating systems? Start with our Financial Operating System 101 Guide.

What is AI Financial Forecasting?

AI financial forecasting combines artificial intelligence and machine learning with financial data to predict future financial performance. Unlike static spreadsheet models, AI systems:

- Learn from historical patterns

- Adapt to changing business conditions

- Identify non-obvious trends

- Provide probabilistic scenarios (best/worst/likely)

- Continuously improve accuracy over time

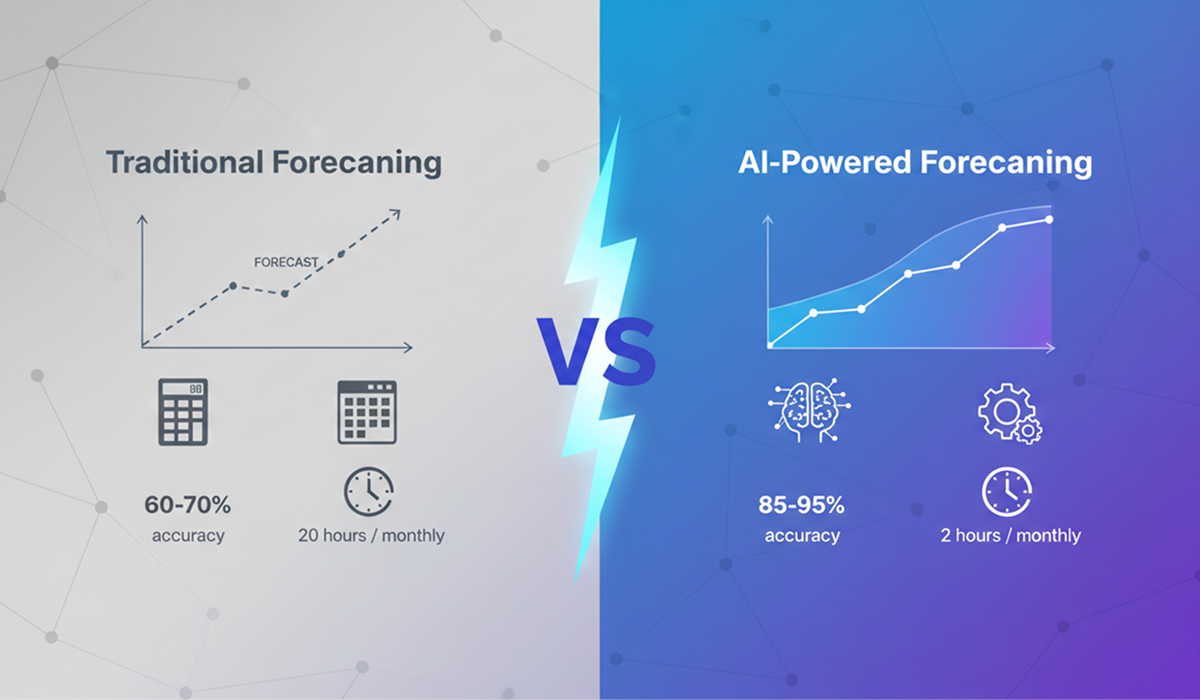

Traditional Forecasting vs AI Forecasting

| Aspect | Traditional | AI-Powered |

|---|---|---|

| Accuracy | 60-70% | 85-95% |

| Update Frequency | Monthly | Real-time |

| Time Required | 10-20 hours/month | 1-2 hours/month |

| Scenarios | 2-3 manual | Unlimited automated |

| Pattern Recognition | Limited | Advanced |

| Error Detection | Manual review | Automatic alerts |

| Learning | Static | Continuous |

Many founders still rely on spreadsheets for forecasting. See why that's problematic: UniversalFlow vs Spreadsheets Comparison.

Why Startups Need AI Financial Forecasting

1. Limited Financial Expertise

Most founders aren't finance experts. AI bridges this gap by:

- Automating complex calculations

- Providing plain-English insights

- Highlighting what matters most

- Suggesting corrective actions

2. Resource Constraints

Early-stage startups can't afford full-time CFOs. AI provides:

- CFO-level analysis at fraction of cost

- 24/7 monitoring and alerts

- Scalable as company grows

- No hiring/training overhead

3. Rapid Changes

Startup environments change quickly. AI handles:

- Volatile revenue patterns

- Fluctuating expenses

- Market uncertainties

- Pivot scenarios

Avoiding common forecasting mistakes is crucial. Learn more: Why Founders Fail at Financial Planning.

4. Investor Expectations

Investors demand accurate forecasts. AI delivers:

- Data-driven projections

- Multiple scenario planning

- Confidence intervals

- Professional reporting

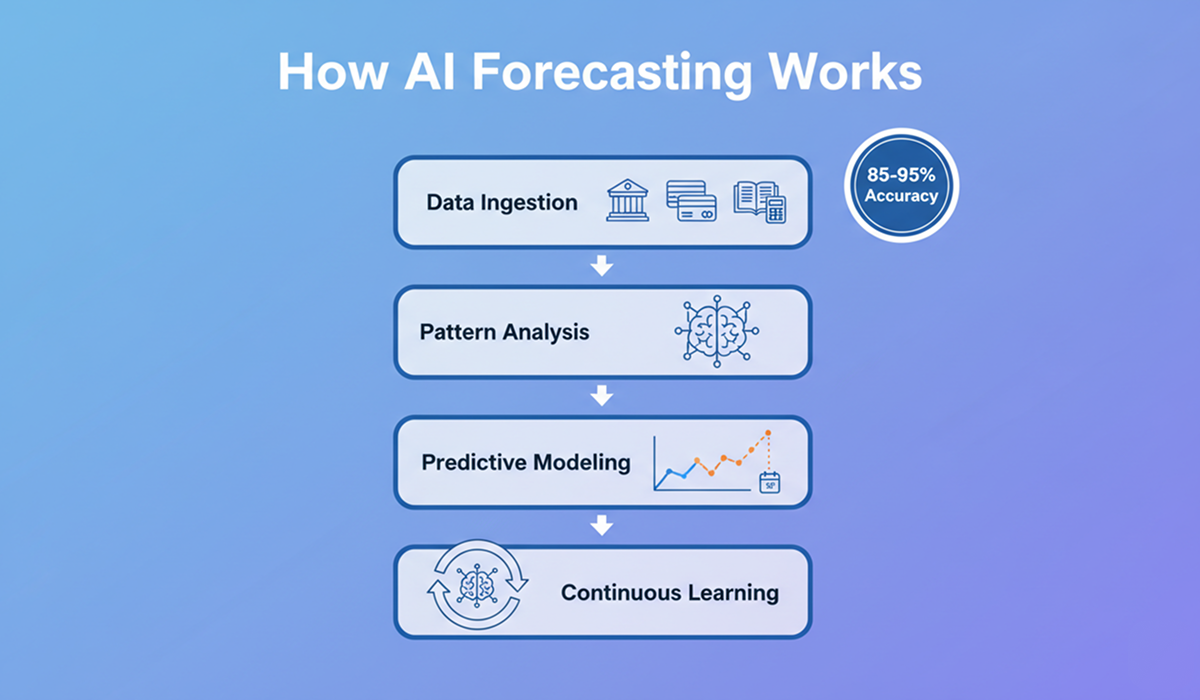

How AI Financial Forecasting Works

Step 1: Data Ingestion

AI systems automatically collect data from:

- Bank accounts and transactions

- Accounting software (QuickBooks, Xero)

- Payment processors (Stripe, PayPal)

- CRM systems (Salesforce, HubSpot)

- HR/Payroll platforms

Step 2: Pattern Analysis

Machine learning algorithms identify:

- Seasonal trends: Revenue/expense cycles

- Growth patterns: Month-over-month changes

- Correlations: Relationships between metrics

- Anomalies: Unusual transactions or trends

- Leading indicators: Early warning signals

Step 3: Predictive Modeling

AI generates forecasts using:

- Time series analysis: Historical trend projection

- Regression models: Multi-variable predictions

- Neural networks: Complex pattern recognition

- Monte Carlo simulations: Probability distributions

Step 4: Continuous Learning

System improves by:

- Comparing predictions to actuals

- Adjusting algorithms based on errors

- Incorporating new data patterns

- Refining confidence intervals

Key AI Forecasting Capabilities

1. Cash Flow Prediction

What it forecasts:

- Daily/weekly/monthly cash position

- Expected inflows and outflows

- Cash surplus or deficit periods

- Optimal cash reserves

Business impact:

- Avoid cash crunches

- Plan financing timing

- Optimize payment schedules

- Reduce idle cash

2. Burn Rate Analysis

What it tracks:

- Gross burn (total spending)

- Net burn (spending minus revenue)

- Burn rate trends

- Runway remaining

Business impact:

- Early warning of unsustainable burn

- Hiring/spending guardrails

- Fundraising timing

- Expense optimization targets

3. Revenue Forecasting

What it predicts:

- Monthly recurring revenue (MRR)

- Customer acquisition rates

- Churn patterns

- Average revenue per user (ARPU)

Business impact:

- Sales target setting

- Resource allocation

- Growth planning

- Valuation preparation

4. Expense Prediction

What it forecasts:

- Personnel costs with hiring plans

- Variable costs tied to revenue

- Fixed overhead expenses

- One-time/project expenses

Business impact:

- Budget accuracy

- Cost control

- Profitability planning

- Investment decisions

5. Scenario Modeling

What it simulates:

- Best/worst/realistic cases

- Impact of new hires

- Effect of price changes

- Fundraising outcomes

Business impact:

- Risk assessment

- Strategic planning

- Decision confidence

- Contingency preparation

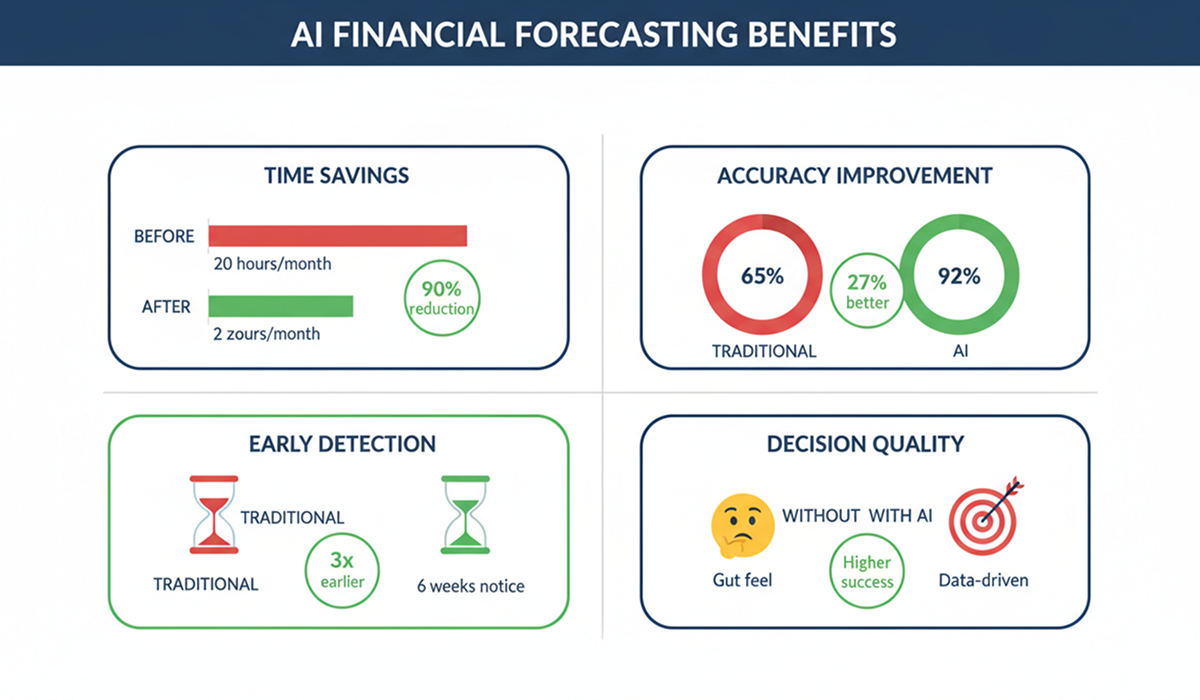

Real-World Benefits for Startups

Time Savings

Before AI:

- 15-20 hours/month on financial modeling

- Manual data entry and reconciliation

- Spreadsheet maintenance and debugging

With AI:

- 1-2 hours/month reviewing insights

- Automatic data synchronization

- Zero manual calculations

Result: 80-90% time reduction

Accuracy Improvements

Traditional Forecasting:

- 60-70% accuracy

- Wide error margins

- Frequent revisions needed

AI Forecasting:

- 85-95% accuracy

- Narrow confidence intervals

- Self-correcting over time

Result: 25-35% accuracy gain

Early Problem Detection

Traditional Approach:

- Discover issues during monthly reviews

- React after problems occur

- Limited visibility into trends

AI Approach:

- Real-time anomaly detection

- Proactive alerts weeks in advance

- Clear trend visibility

Result: 3-6 week early warning

Better Decision Making

Without AI:

- Gut feel decisions

- Limited scenario analysis

- Unclear trade-offs

With AI:

- Data-driven choices

- Comprehensive scenario modeling

- Quantified trade-offs

Result: Higher success rate on strategic decisions

Common AI Forecasting Use Cases

Use Case 1: Fundraising Preparation

Challenge: Need to show investors credible 3-year projections

AI Solution:

- Generates multiple growth scenarios

- Validates assumptions against comparable companies

- Provides confidence intervals

- Creates professional visualizations

Outcome: Investor-ready financial model in hours, not weeks

Use Case 2: Hiring Decisions

Challenge: Should we hire 3 new engineers?

AI Solution:

- Models impact on burn rate

- Forecasts runway reduction

- Calculates break-even timing

- Simulates alternative scenarios

Outcome: Data-backed hiring decision with clear financial implications

Use Case 3: Pricing Strategy

Challenge: Evaluating 20% price increase

AI Solution:

- Predicts revenue impact with churn

- Forecasts cash flow changes

- Models competitive response

- Calculates optimal price point

Outcome: Optimized pricing with projected financial outcomes

Use Case 4: Runway Management

Challenge: How long until we need more funding?

AI Solution:

- Calculates runway under various scenarios

- Identifies expense reduction options

- Forecasts revenue acceleration needs

- Recommends optimal fundraising timing

Outcome: Clear runway visibility and proactive fundraising plan

Implementing AI Forecasting: Step-by-Step

Phase 1: Setup (Week 1)

Day 1-2: Data Connection

- Connect bank accounts

- Integrate accounting software

- Link payment processors

- Import historical data

Day 3-4: Configuration

- Set up revenue categories

- Define expense classifications

- Configure team roles

- Establish KPIs

Day 5-7: Validation

- Review AI-generated forecasts

- Adjust assumptions

- Test scenarios

- Train team

Phase 2: Optimization (Month 1)

Week 2-3: Refinement

- Compare predictions to actuals

- Tune forecast parameters

- Add missing data sources

- Customize dashboards

Week 4: Integration

- Incorporate into weekly reviews

- Share with leadership team

- Set up automated reports

- Define alert thresholds

Phase 3: Mastery (Month 2+)

Ongoing Activities:

- Regular forecast reviews

- Scenario planning exercises

- Investor report generation

- Strategic decision support

Choosing an AI Financial Forecasting Tool

Essential Features:

✅ Automatic data sync from multiple sources

✅ AI-powered predictions with confidence intervals

✅ Scenario modeling capabilities

✅ Real-time dashboards and alerts

✅ Investor-ready reporting

✅ Free tier or trial for early-stage startups

✅ Mobile accessibility

✅ Collaborative features for teams

Red Flags:

❌ Requires manual data entry

❌ No AI/ML capabilities (just formulas)

❌ Steep learning curve

❌ No free option for startups

❌ Limited integrations

❌ Poor customer support

❌ Vendor lock-in concerns

Evaluation Checklist:

Ease of Use (1-10): ____

- Setup time < 1 hour?

- Intuitive interface?

- Plain-English insights?

AI Capabilities (1-10): ____

- True machine learning?

- Continuous improvement?

- Pattern recognition?

Accuracy (1-10): ____

- Historical back-testing results?

- Confidence intervals provided?

- Error rate disclosed?

Value (1-10): ____

- Free tier available?

- ROI clear?

- Scalable pricing?

Support (1-10): ____

- Response time?

- Documentation quality?

- Training resources?

Best Practices for AI Forecasting

1. Start with Clean Data

- Ensure accurate historical records

- Categorize transactions consistently

- Remove duplicates and errors

- Establish data quality standards

2. Trust but Verify

- Review AI predictions critically

- Validate against business knowledge

- Adjust unrealistic assumptions

- Document override reasons

3. Embrace Scenarios

- Model best/worst/realistic cases

- Test sensitivity to key variables

- Plan contingencies for each scenario

- Update scenarios as conditions change

4. Act on Insights

- Set up proactive alerts

- Review forecasts weekly

- Make data-driven decisions

- Track decision outcomes

5. Continuous Improvement

- Compare forecasts to actuals monthly

- Refine assumptions based on learnings

- Incorporate new data sources

- Share feedback with AI system

Limitations of AI Financial Forecasting

What AI Can't Do

1. Black Swan Events

- AI can't predict unprecedented situations (pandemics, market crashes, regulatory changes)

- Based on historical patterns, so novel events aren't captured Solution: Always maintain scenario planning for extreme cases

2. Dramatic Business Model Changes

- AI struggles with pivots or complete business model shifts

- Needs time to learn new patterns (typically 2-3 months) Solution: Use automated overrides during transition periods

3. Very Early Stage (<3 months data)

- Limited historical data = less accurate predictions (assumptions)

- AI needs patterns to learn from

- Solution: Assume patterns with industry benchmarks

4. Human Behavior Predictions

- Can't predict individual customer or employee decisions

- Aggregate patterns work, but individual cases vary

- Solution: Use confidence intervals and ranges, not point estimates

5. External Market Factors

- Doesn't automatically incorporate macro trends (unless explicitly fed data)

- Can't predict competitor moves or market shifts

- Solution: Supplement with market research and strategic planning

When Manual Forecasting Is Better

Use traditional/automated methods when:

- You're in first 1-2 months of operation (not enough data)

- Planning a major pivot or business model change

- Modeling hypothetical scenarios with no historical basis

- Need to incorporate non-quantifiable factors (team morale, market sentiment)

Use AI forecasting when:

- You have 3 months of consistent data

- Business model is relatively stable

- Want to identify patterns you might miss manually

- Need fast, frequent forecast updates

The Hybrid Approach Works Best

Recommended:

- AI handles routine forecasting and pattern detection

- Humans make strategic adjustments for known future changes

- Combine AI predictions with expert judgment

- Use AI for scenarios, humans for final decisions

Expert Opinion: "AI is a powerful tool, but it's not magic. The best forecasts come from combining AI's pattern recognition with human strategic insight. Use AI to augment, not replace, human judgment."

— Dr. Emily Watson, Financial Systems Researcher

Accuracy Expectations by Stage

| Startup Stage | Expected AI Accuracy | Why |

|---|---|---|

| Pre-seed (<3 months data) | 60-70% | Limited historical data |

| Pre-seed (3-6 months data) | 70-80% | Some patterns emerging |

| Seed (6-12 months data) | 80-90% | Clear patterns established |

| Series A (12+ months data) | 85-95% | Mature data, stable model |

Key Takeaway: AI forecasting accuracy improves with time and data. Don't expect 95% accuracy on day one.

Problem: "We'll set this up when we have time"

Solution: Start with basic setup, expand over time

The Future of AI Financial Forecasting

Next-Generation Capabilities:

- Predictive Analytics: Forecasting market trends, not just internal metrics

- Natural Language Interface: Ask questions in plain English

- Autonomous Recommendations: AI suggests actions, not just insights

- Cross-Company Benchmarking: Compare to similar startups automatically

- Integrated Fundraising: AI recommends optimal raise timing and amount

Emerging Trends:

- Integration with AI assistants (ChatGPT, Claude)

- Real-time collaboration features

- Automated investor updates

- Predictive hiring recommendations

- Dynamic pricing optimization

Conclusion

Automated financial forecasting is no longer a luxury—it's a necessity for competitive startups. The technology has matured to the point where:

✅ Setup takes minutes, not weeks

✅ Accuracy exceeds 85% consistently

✅ Cost is $0-$500/month (vs $100k+ for a CFO)

✅ No finance expertise required

✅ ROI is immediate through time savings

The question isn't whether to adopt AI forecasting, but which tool to choose and when to start.

For early-stage startups: Start with free AI-powered financial operating systems like Uniflow. Begin simple, add complexity as you grow.

For growth-stage companies: Invest in comprehensive AI forecasting with advanced scenario modeling and team collaboration to drive strategic, cross-functional decision-making and support scalable growth.

Ready to replace spreadsheet guesswork with AI-powered forecasts? Try a free AI-powered automated financial operating system like Uniflow, Runway, or Finmark—all offer AI forecasting capabilities for startups.

Related Articles

- Financial Operating System 101: Complete Guide

- UniversalFlow vs Spreadsheets: Why Make the Switch

- Financial OS vs Traditional FP&A

Frequently Asked Questions

Q: How accurate is AI financial forecasting compared to manual methods?

A: AI forecasting typically achieves 85-95% accuracy vs 60-70% for manual spreadsheet models. Accuracy improves over time as the AI learns from your specific business patterns.

Q: Do I need a data science background to use AI forecasting tools?

A: No. Modern AI forecasting tools are designed for non-technical founders. They provide insights in plain English and require no coding or data science knowledge.

Q: How much historical data do I need for AI forecasting to work?

A: Minimum 3-6 months of data for basic forecasting. 12+ months ideal for seasonal patterns. AI can augment limited data with industry benchmarks.

Q: Can AI forecasting handle my unique business model?

A: Yes. AI adapts to any business model by learning from your specific data patterns. It's more flexible than rigid spreadsheet templates.

Q: What if my business changes dramatically (pivot, new product, etc.)?

A: AI systems adapt quickly to major changes. You can manually adjust assumptions for known future changes while AI learns new patterns.

Q: How much does AI financial forecasting cost?

A: Many platforms offer free tiers for early-stage startups. Paid plans range from $50-$500/month—far less than hiring a financial analyst.

Q: Will AI forecasting replace my CFO or financial advisor?

A: No. AI augments, not replaces, human expertise. It handles routine forecasting so CFOs can focus on strategy and advisory.

Q: How long does it take to see ROI from AI forecasting?

A: Immediate time savings (80% reduction in manual work). Financial decision improvements show ROI within 1-3 months.

Q: Is my financial data secure with AI forecasting tools?

A: Reputable tools use bank-level encryption, secure cloud storage, and comply with financial regulations (SOC 2, GDPR, etc.). Always verify security certifications.

Q: Can AI forecast black swan events or unprecedented situations?

A: No. AI forecasts based on patterns. It can't predict unprecedented events (pandemic, market crash, etc.). Use scenario planning for extreme cases.

Keywords: AI financial forecasting, financial forecasting for founders, AI-powered financial forecasting, cash flow forecasting for startups, AI for startups, financial forecasting tools, machine learning finance, predictive financial analytics

About the Author: