Why Founders Fail at Financial Planning (And How to Fix It)

TL;DR

82% of startups fail due to cash flow mismanagement, yet most founders spend less than 2 hours per month on financial planning. The seven deadly mistakes: ignoring cash flow, over-optimistic forecasting, no runway tracking, reactive (not proactive) planning, treating finance as a "later" problem, relying on spreadsheets alone, and not asking for help. Solution: Adopt an AI-powered financial operating system early.

Learn the solution: Financial Operating System 101 Guide

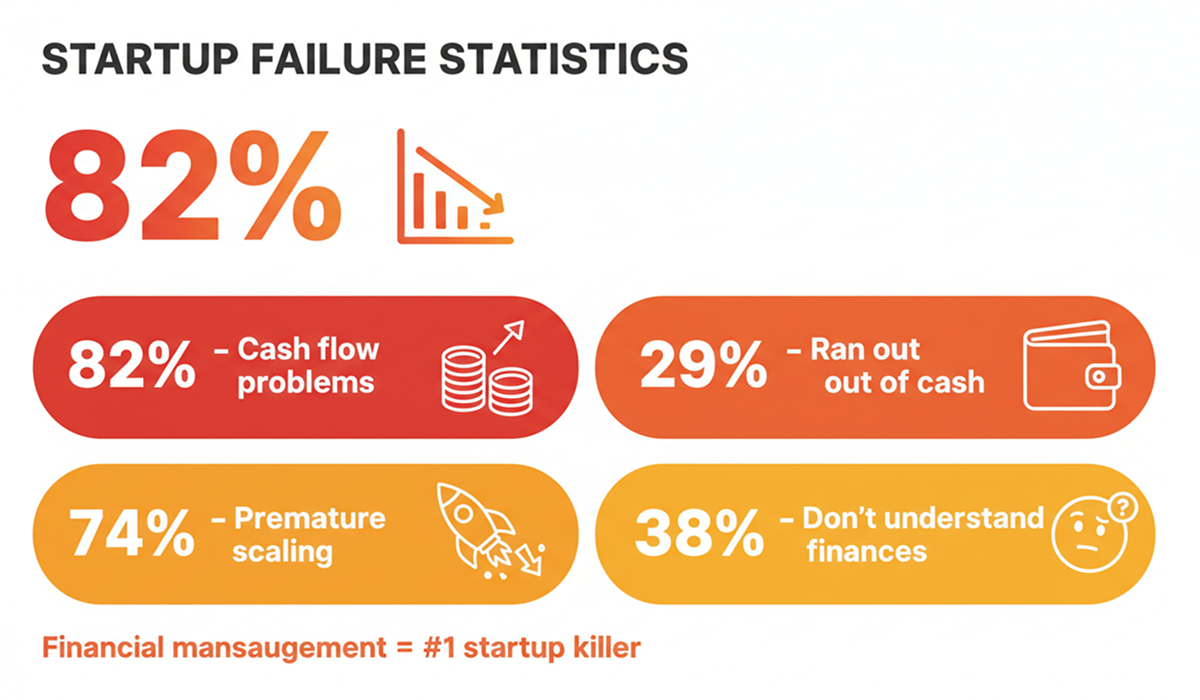

The Harsh Reality: Numbers Don't Lie

- 82% of small businesses fail due to cash flow problems (U.S. Bank study)

- 29% of startups run out of cash before achieving product-market fit (CB Insights)

- 74% of high-growth startups fail due to premature scaling (Startup Genome)

- 38% of founders admit they don't understand their own financials (First Round Capital)

Translation: Financial mismanagement is the #1 killer of startups—bigger than market competition, product issues, or team problems.

Why Founders Struggle with Financial Planning

The Core Problem: Wrong Priorities

Most founders are:

- Engineers who love building product

- Designers who love creating experiences

- Sales people who love closing deals

- Marketers who love growing audiences

What they're not: Finance experts who love forecasting cash flow.

The Misconception

"I'll hire a CFO when we raise our Series A"

By then, it's often too late. 60% of startups that fail do so between seed and Series A—precisely because they lack financial discipline.

The Avoidance Pattern

Founder mindset:

- "Finance is boring" → Avoidance

- "I'll figure it out later" → Procrastination

- "We're growing, we're fine" → False security

- "Someone else should handle this" → Delegation without oversight

- Result: Financial crisis

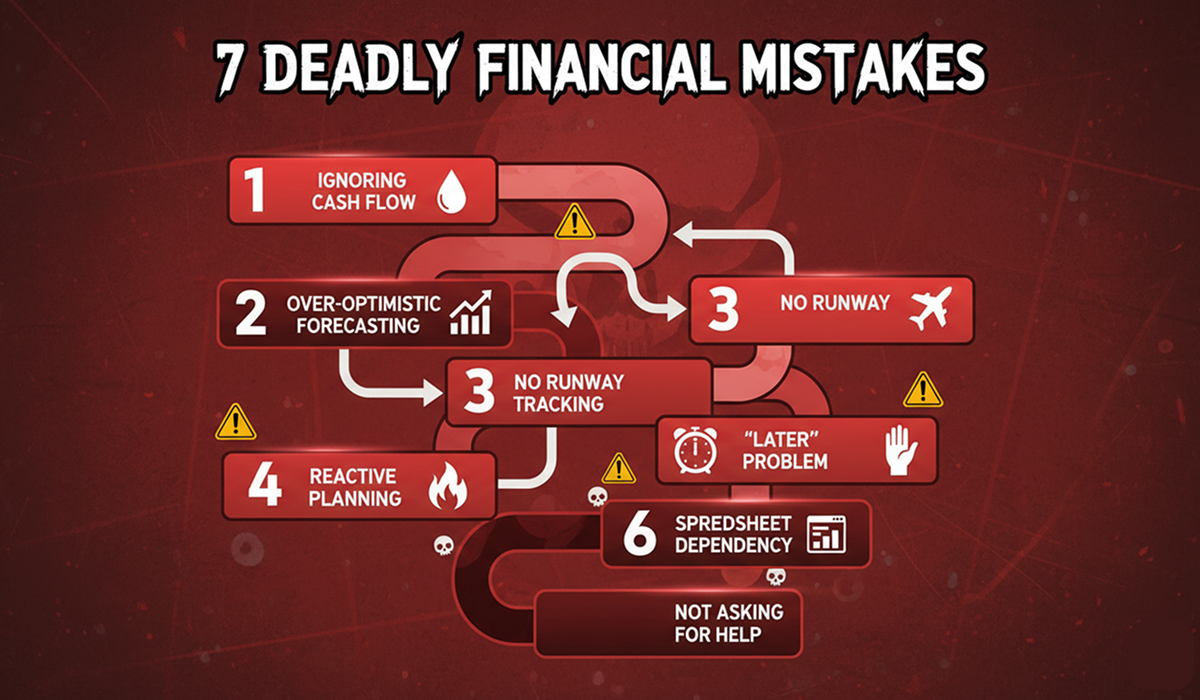

The 7 Deadly Mistakes of Founder Financial Planning

Mistake #1: Ignoring Cash Flow (Until It's Too Late)

What Founders Do:

- Check bank account balance occasionally

- Assume profitability = healthy cash flow

- React only when money gets tight

- Confuse revenue with cash

Why It's Fatal:

- Can be "profitable" on paper but run out of cash

- Large contracts with net-60 payment terms create cash gaps

- Sudden expenses catch you off-guard

- No time to fundraise when crisis hits

Real Example: SaaS startup lands $500k annual contract, celebrates, hires 3 engineers. Client pays net-60. Company runs out of cash in month 2 despite "big win."

The Fix:

- Track cash flow weekly, not monthly

- Understand the difference between profit and cash

- Model cash flow impact of every decision

- Use AI-powered cash flow forecasting

Tool: Uniflow's real-time cash flow dashboard shows exactly when cash comes in/out with AI predictions.

Mistake #2: Over-Optimistic Forecasting

What Founders Do:

- Project hockey stick growth

- Assume no customer churn

- Ignore seasonal fluctuations

- Underestimate costs

- Overestimate sales cycles

The Classic Pattern:

Founder Projection: $100k MRR by month 12

Reality: $15k MRR by month 12

Result: Ran out of money in month 10

Why It Happens:

- Optimism bias (necessary for entrepreneurship)

- Pressure from investors to show ambition

- Lack of historical data

- Confirmation bias (ignoring contradictory data)

The Fix:

- Create three scenarios: best, realistic, worst

- Plan around the realistic case

- Update forecasts monthly with actuals

- Let AI remove bias from projections

Best Practice:

- Promise investors realistic case

- Celebrate beating realistic case

- Don't defend best case when it doesn't happen

Mistake #3: No Runway Tracking

What Founders Don't Know:

- Exact months of runway remaining

- When to start fundraising (need 6-9 months)

- Impact of hiring on runway

- Current burn rate trend

The Dangerous Question:

"How much runway do we have?" Founder: "Uh... let me calculate... maybe 8 months?" Actual runway: 4 months

Why This Kills Startups:

- Fundraising takes 3-6 months minimum

- Running out mid-raise = terrible negotiating position

- Emergency fundraising = unfavorable terms

- No runway = no runway (literally)

The Fix:

- Know your runway to the day

- Set alerts at 9, 6, and 3 months remaining

- Start fundraising at 9+ months runway

- Track burn rate changes weekly

Critical Metrics to Monitor:

- Gross burn (total monthly spending)

- Net burn (spending minus revenue)

- Runway at current burn

- Runway with planned hires

- Break-even timeline

Mistake #4: Reactive (Not Proactive) Planning

Reactive Founder:

- "Oh no, we're running low on cash!"

- "This client churned, now we're in trouble"

- "Didn't realize that hire would hurt this much"

- "Invoice payment was delayed, crisis mode"

Proactive Founder:

- "AI predicts cash crunch in 8 weeks, let's act now"

- "Churn forecast shows risk, implementing retention plan"

- "Scenario analysis shows hiring impact, adjusting timeline"

- "Cash flow forecast accounts for payment delays"

The Difference:

- Reactive: Scrambling, poor decisions, panic

- Proactive: Prepared, strategic, calm

The Fix:

- Weekly financial reviews (non-negotiable)

- AI-powered early warning alerts

- Scenario planning for major decisions

- 13-week rolling cash forecast

Mistake #5: Treating Finance as a "Later" Problem

Common Founder Timeline:

- Months 1-6: "Too early to worry about financials"

- Months 7-12: "We're growing, financials are fine"

- Months 13-18: "We should probably organize this"

- Months 19-24: "OH NO WE'RE OUT OF MONEY"

Why This Is Backward:

- Early decisions have compounding effects

- Bad financial habits are hard to break

- Historical data is valuable for AI forecasting

- Investors want to see financial discipline early

The Fix:

- Implement financial OS on day one

- Track every transaction from the start

- Build financial discipline as a core value

- Use financial data to make better decisions early

Investor Perspective: Seed investors increasingly evaluate financial discipline. A founder who can't answer basic financial questions = red flag.

Mistake #6: Relying on Spreadsheets Alone

The Spreadsheet Trap:

- Build complex financial model

- Spend 15-20 hours/month maintaining it

- Formula breaks, introduces errors

- Can't do real-time analysis

- Becomes outdated quickly

- Doesn't scale with business

See detailed comparison: Uniflow vs Spreadsheets.

Common Spreadsheet Disasters:

- Wrong cell reference breaks entire model

- Copy-paste error cascades through quarters

- Outdated data leads to wrong decision

- Multiple versions cause confusion

- Can't collaborate effectively

The Fix:

- Use purpose-built financial operating systems

- Leverage AI for forecasting

- Automate data entry and calculations

- Enable real-time collaboration

- Eliminate manual errors

The Upgrade: Spreadsheets → AI-powered financial OS (Uniflow, Runway, Finmark, etc.) = 90% time savings + 25% accuracy improvement

Learn how AI transforms forecasting: AI Financial Forecasting for Startups.

Mistake #7: Not Asking for Help

Founder Ego:

- "I should figure this out myself"

- "Asking for help shows weakness"

- "I'll hire a CFO eventually"

- "Financial advisors are expensive"

Reality Check:

- Nobody expects founders to be finance experts

- Investors respect founders who know their limits

- Early financial mistakes are expensive

- Modern tools provide CFO-level insights for free

The Fix:

- Join founder communities (share learnings)

- Use AI-powered financial tools (free CFO advice)

- Hire fractional CFO for critical decisions ($1-2k/month)

- Take advantage of investor office hours

- Read financial planning resources

The Compounding Effect of Financial Mistakes

Month 1-3: Small Mistakes

- No organized financial tracking

- Estimated runway, not calculated

- No cash flow forecast

Impact: Minimal, seems fine

Month 4-6: Growing Problems

- Overhire based on optimistic projections

- Miss early warning signs

- Make decisions without data

Impact: Building up

Month 7-9: Serious Issues

- Burn rate increases 40%

- Runway shrinking faster than expected

- Too late to adjust course easily

Impact: Concerning

Month 10-12: Crisis Mode

- Discovered runway is 3 months, not 8

- Scrambling to raise emergency funding

- Bad terms or shutdown

Impact: Potentially fatal

Lesson: Small financial mistakes compound. Fix them early when they're easy, not late when they're catastrophic.

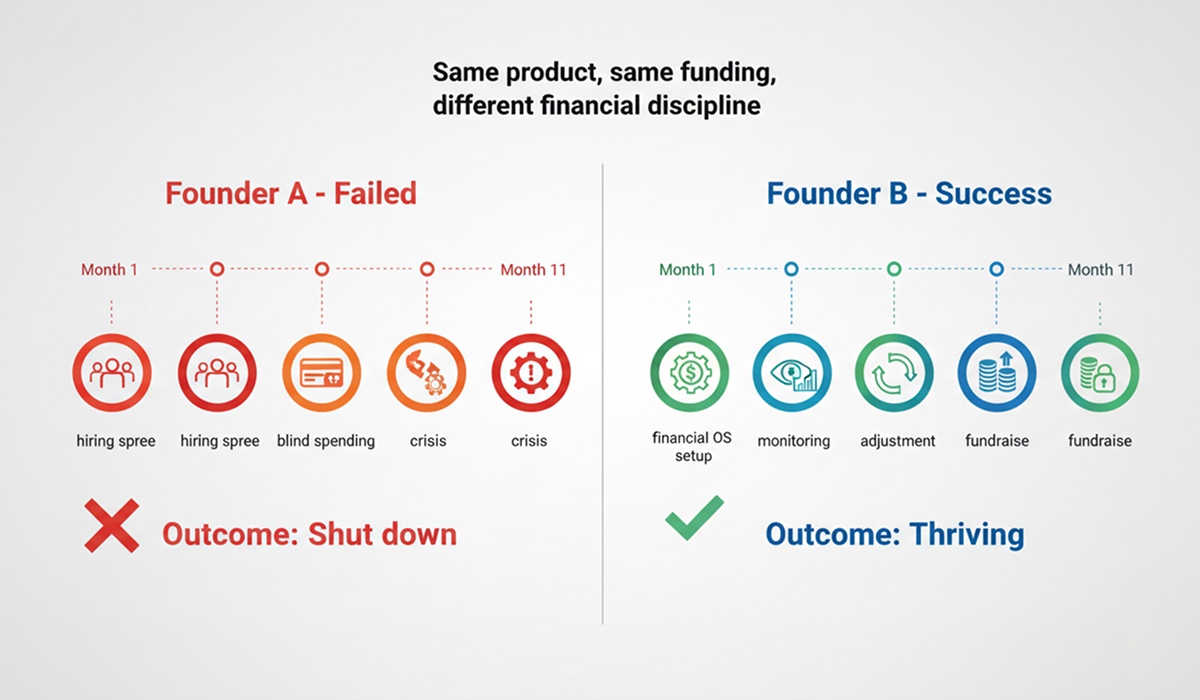

Case Study: Two Founders, Different Outcomes

Founder A: "I'll Figure It Out Later"

Profile:

- Strong product, great market

- Raised $500k seed

- Ignored financial planning

Timeline:

- Month 3: Hired aggressively ("we're growing!")

- Month 6: Didn't track burn rate increase

- Month 9: Realized only 2 months runway left

- Month 10: Emergency fundraising

- Month 11: Ran out of cash

- Outcome: Shut down

Founder B: "Financial Discipline from Day 1"

Profile:

- Similar product, similar market

- Raised $500k seed

- Implemented financial OS immediately

Timeline:

- Month 1: Set up Uniflow, tracked everything

- Month 3: AI predicted cash flow risk from planned hires

- Month 4: Adjusted hiring timeline based on data

- Month 8: Started fundraising with 10 months runway

- Month 11: Closed Series A from position of strength

- Outcome: Thriving

The Difference: Proactive financial management vs reactive crisis mode

Alternative Approaches (Beyond Financial OS)

Not everyone needs a full financial operating system immediately. Here are alternatives and when they make sense:

1. Spreadsheets (DIY Approach)

When to Use: Pre-revenue, <3 months of data, very simple business model Pros: Free, full control, no learning curve if you know Excel Cons: Time-intensive (15-20 hours/month), error-prone, doesn't scale Cost: $0 in software, but $3,000-4,000/month in opportunity cost

2. Bookkeeper ($500-1,500/month)

When to Use: Need help with transaction categorization and tax prep Pros: Accurate books, professional tax preparation, clean records Cons: Backward-looking only, no forecasting, no strategic insights Best With: Combine with financial OS for complete solution

3. Fractional CFO ($2,000-5,000/month)

When to Use: Complex financial situation, raising $1M+, preparing for Series A Pros: Expert human guidance, strategic advice, fundraising experience Cons: Expensive for early-stage, limited hours (10-20/month), reactive not proactive Best With: Pair with financial OS for day-to-day operations

4. Financial Operating System ($0-500/month)

When to Use: Most startups from day one through Series A Pros: Automated, AI-powered, 24/7 availability, scales with you Cons: Initial setup time, not a replacement for strategic CFO advice at later stages Popular Options: Uniflow (free for early-stage), Runway, Pilot, Finmark

Recommended Combination by Stage:

| Stage | Best Approach | Monthly Cost |

|---|---|---|

| Pre-Seed | Financial OS (free tier) | $0 |

| Seed | Financial OS + occasional CFO consult | $50-500 |

| Series A | Financial OS + Fractional CFO | $2,500-4,000 |

| Series B+ | Financial OS + Full-time CFO | $10,000+ |

Reality Check: "You don't need to choose just one approach. The best founders use a financial OS for daily operations and execution, then bring in a fractional CFO for strategic decisions and fundraising."

— Jennifer Wu, Partner at Seed Stage Ventures

How to Fix Your Financial Planning (Starting Today)

Week 1: Foundation

Day 1-2: Implement Financial OS

- Sign up for Uniflow (free)

- Connect bank accounts

- Import historical data

- Set up basic categories

Day 3-4: Understand Your Numbers

- Review AI-generated cash flow forecast

- Calculate exact runway

- Identify your burn rate

- Set up critical alerts

Day 5-7: Create Discipline

- Schedule weekly financial reviews (30 min)

- Share key metrics with team

- Set up investor-ready reports

- Document financial policies

Week 2-4: Optimization

Week 2: Scenario Planning

- Model hiring impact on runway

- Forecast revenue scenarios

- Plan contingencies

- Set up milestone tracking

Week 3: Process Building

- Weekly finance review with leadership

- Monthly forecast updates

- Quarterly board reporting

- Ongoing expense optimization

Week 4: Advanced Planning

- Build fundraising timeline

- Create investor update templates

- Model exit scenarios

- Integrate with strategic planning

Ongoing: Financial Excellence

Daily:

- Check AI alerts (2 minutes)

- Approve expenses thoughtfully

Weekly:

- Review cash flow and runway (30 minutes)

- Analyze key metrics

- Make data-driven decisions

Monthly:

- Update forecasts with actuals

- Generate investor reports

- Strategic financial planning

Quarterly:

- Deep financial analysis

- Board deck preparation

- Long-term planning

Tools & Resources for Founder Financial Success

Essential Tools

- Financial Operating System: Uniflow (free for early-stage)

- Accounting Software: QuickBooks or Xero (integrates with Uniflow)

- Bank Account: Dedicated business banking with API access

- Payment Processor: Stripe/PayPal (auto-syncs)

Learning Resources

Books:

- "The Lean Startup" by Eric Ries (unit economics)

- "Venture Deals" by Brad Feld (fundraising financials)

- "Financial Intelligence" by Karen Berman (finance for non-finance)

Courses:

- Y Combinator Startup School (free)

- FirstRound Capital resources

- SaaS Financial Modeling courses

Communities:

- Indie Hackers (transparent discussions)

- SaaStr community

- Local founder groups

When to Hire Professional Help

Fractional CFO ($1-3k/month):

- Raised >$1M

- Complex revenue models

- Preparing for Series A

- Multiple entities/locations

Full-time CFO ($120-200k/year):

- Series A+ funded

- $5M+ ARR

- 30+ employees

- Fundraising for Series B

Financial Advisor (hourly):

- Specific questions

- Model validation

- Fundraising prep

- Strategic decisions

The Mindset Shift: From Avoidance to Advantage

Old Mindset

- Finance is boring

- It's not my strength

- I'll deal with it later

- Someone else's job

New Mindset

- Financial data powers better decisions

- Understanding numbers is competitive advantage

- Proactive financial management prevents crises

- Financial discipline attracts investors

The Competitive Edge

Founders with strong financial discipline:

- Make faster, better decisions

- Negotiate from strength

- Attract better investors

- Scale more efficiently

- Exit more successfully

Conclusion: Financial Planning as Competitive Advantage

Most founders fail at financial planning not because they're incapable, but because:

- They avoid it (boring)

- They delay it ("later")

- They complicate it (spreadsheets)

- They do it alone (ego)

The solution is simple:

- Start on day one

- Use modern AI-powered tools

- Make it a weekly habit

- Ask for help when needed

The reward:

- Avoid the #1 cause of startup failure

- Make better strategic decisions

- Raise funding from position of strength

- Scale sustainably

- Exit successfully

Your competitive advantage isn't just your product—it's your financial discipline.

Ready to fix your financial planning? Start with a free AI-powered financial operating system like Uniflow, Runway, or Finmark. 15 minutes to set up, lifetime of better decisions.

Related Articles

- Financial Operating System 101: Complete Guide

- How AI Improves Financial Forecasting

- Uniflow vs Spreadsheets Comparison

- Financial OS vs Traditional FP&A

Frequently Asked Questions

Q: I'm pre-revenue. Do I really need financial planning?

A: YES. Pre-revenue is when runway is most critical. You need to know exactly how long you can operate and when to start fundraising.

Q: I'm technical, not financial. Can I really do this?

A: Absolutely. Modern financial OS tools are designed for non-finance founders. AI handles the complexity, you make the decisions.

Q: Won't a financial OS be expensive?

A: Uniflow is free for early-stage startups. The cost of NOT having financial discipline is 100x higher.

Q: How much time should I spend on financial planning?

A: With AI tools: 30-60 minutes per week. Without: 15-20 hours per month. Choose wisely.

Q: When should I hire a CFO?

A: Part-time/fractional after raising $1M+. Full-time after Series A or $5M+ ARR. But use financial OS from day one.

Q: What if I've already made these mistakes?

A: Start fixing them today. Most founders do make these mistakes—the key is correcting course quickly.

Q: Can financial planning save a struggling startup?

A: If you have 6+ months runway: yes, absolutely. If you have <3 months: maybe, but it's harder. Prevention is always better.

Q: What's the #1 financial metric I should watch?

A: Runway. Everything else matters, but if you run out of runway, game over.

Keywords: why founders fail at financial planning, startup financial mistakes, financial planning for founders, cash flow management for startups, runway tracking, burn rate calculator, founder financial education, startup finance

About the Author: