Financial Operating System vs Traditional FP&A: What Startups Really Need

TL;DR

Traditional FP&A (Financial Planning & Analysis) requires hiring a $120k+ CFO and takes weeks to produce reports. Modern financial operating systems provide the same insights instantly using AI, cost $0-$500/month, and require no finance expertise. For startups with <$10M revenue, a financial OS delivers 95% of FP&A value at 5% of the cost.

New to financial operating systems? Start with our Financial Operating System 101 Guide.

What is Traditional FP&A?

FP&A (Financial Planning & Analysis) is the traditional corporate approach to financial management, typically involving:

- Dedicated finance team (CFO + analysts)

- Complex Excel models

- Monthly/quarterly reporting cycles

- Manual data consolidation

- Static forecasts and budgets

- Board presentation preparation

Traditional FP&A Process

Week 1-2: Data collection from multiple sources

Week 3: Consolidation and reconciliation

Week 4: Analysis and report creation

Week 5: Presentation to leadership/board

Week 6-8: Rinse and repeat

Result: By the time you get insights, they're 4-6 weeks old.

What is a Financial Operating System?

A Financial OS is a modern, AI-powered platform that:

- Automates data collection in real-time

- Uses machine learning for forecasting

- Provides instant insights and alerts

- Requires minimal finance expertise

- Scales automatically with business

- Updates continuously, not monthly

Financial OS Process

Instant: Real-time data sync

Automatic: AI-powered analysis

Continuous: Always current insights

Accessible: Entire team can use it

Result: Actionable insights available 24/7, updated in real-time.

Head-to-Head Comparison

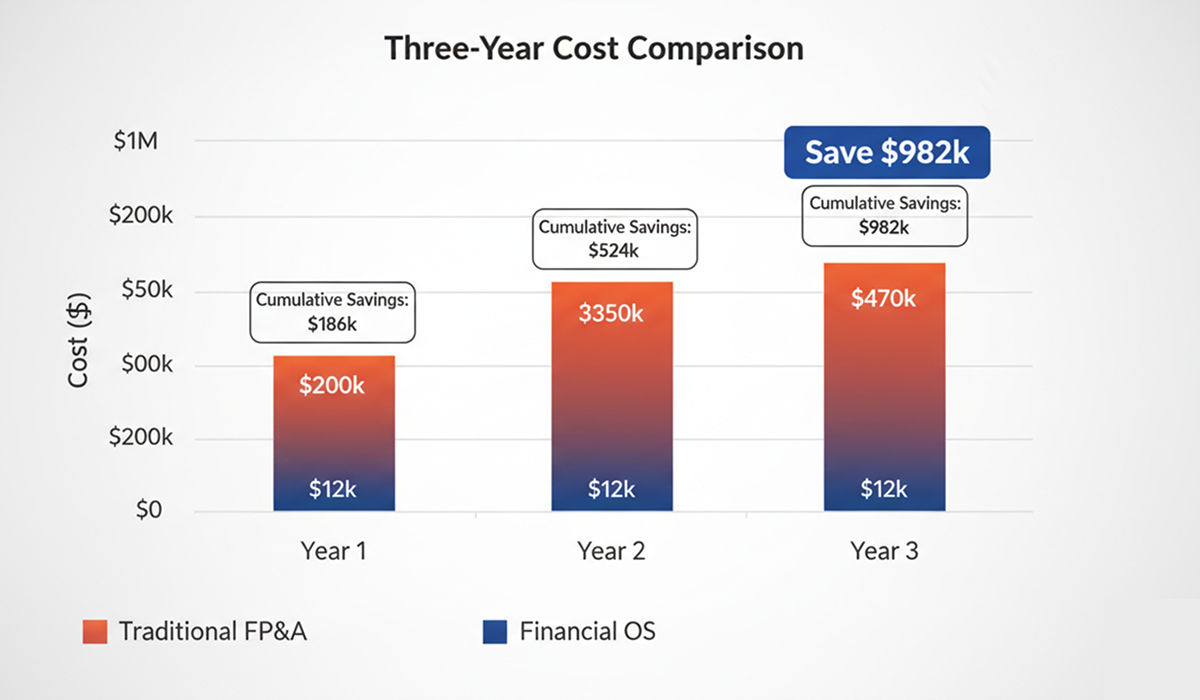

Cost Comparison

| Component | Traditional FP&A | Financial OS |

|---|---|---|

| CFO Salary | $120-200k/year | $0 |

| Analyst(s) | $60-90k each | $0 |

| Software | $5-20k/year | $0-$6k/year |

| Training | $10-20k/year | $0 |

| Overhead | 30% of salaries | $0 |

| Total Year 1 | $200-350k | $0-6k |

| Total Year 3 | $600k-1M+ | $0-18k |

Savings: $582k-$982k over 3 years

Time Comparison

| Task | Traditional FP&A | Financial OS |

|---|---|---|

| Setup | 4-8 weeks | 15 minutes |

| Monthly Close | 5-10 days | Instant |

| Forecast Update | 2-3 days | Real-time |

| Board Report | 3-5 days | 2 clicks |

| Scenario Analysis | 4-8 hours | 2 minutes |

| Ad-Hoc Questions | Hours to days | Instant |

Time Savings: 90-95% reduction

Capability Comparison

| Feature | Traditional FP&A | Financial OS |

|---|---|---|

| Real-Time Data | ❌ Monthly lags | ✅ Always current |

| AI Forecasting | ❌ Manual models | ✅ Machine learning |

| Scenario Planning | ✅ But time-consuming | ✅ Instant |

| Cash Flow Tracking | ✅ Manual process | ✅ Automated |

| Burn Rate Analysis | ✅ Calculated monthly | ✅ Real-time tracking |

| Runway Prediction | ✅ Static calculation | ✅ Dynamic AI prediction |

| Variance Analysis | ✅ But retroactive | ✅ Predictive alerts |

| Board Reporting | ✅ Custom built | ✅ One-click |

| Team Collaboration | ❌ Limited | ✅ Built-in |

| Mobile Access | ❌ Very limited | ✅ Full featured |

Accuracy Comparison

| Metric | Traditional FP&A | Financial OS |

|---|---|---|

| Forecast Accuracy | 65-75% | 85-95% |

| Data Currency | 2-4 weeks lag | Real-time |

| Error Rate | 5-10% (manual) | <1% (automated) |

| Consistency | Varies by person | Always consistent |

When Traditional FP&A Makes Sense

Ideal Scenarios for Traditional FP&A:

-

Large Enterprise ($100M+ revenue)

- Multiple business units

- Complex corporate structure

- Regulatory requirements

- International operations

-

Public Company

- SEC reporting requirements

- Investor relations demands

- Audit complexity

- Compliance needs

-

Heavy M&A Activity

- Frequent acquisitions

- Complex integrations

- Due diligence requirements

- Post-merger consolidation

Warning Signs You DON'T Need Traditional FP&A:

- Pre-Series B startup

- <$10M annual revenue

- <50 employees

- Single product/market

- Limited complexity

- Fast-moving business

Reality: 95% of startups don't need traditional FP&A yet.

When a Financial OS Makes More Sense

Perfect for:

-

Early-Stage Startups (Pre-seed to Series A)

- Need financial discipline

- Can't afford CFO

- Fast-changing business

- Data-driven culture

-

Growth-Stage (Series B-C)

- Scaling rapidly

- Need real-time visibility

- Distributed teams

- Multiple stakeholders

-

Resource-Conscious (Any stage)

- Want to optimize spending

- Prefer automation

- Value speed over tradition

- Embrace modern tools

Specific Use Cases:

Fundraising:

- Build investor-ready models in hours

- Show professional financial discipline

- Answer investor questions instantly

- Demonstrate data-driven approach

Hiring Decisions:

- Model financial impact immediately

- See runway implications

- Test different scenarios

- Make informed decisions

Strategic Planning:

- Explore growth scenarios

- Assess risks quickly

- Optimize resource allocation

- Track progress real-time

The Hybrid Approach: Best of Both Worlds

For Series A+ Startups:

Use Financial OS for:

- Day-to-day operations

- Real-time monitoring

- Team collaboration

- Automated forecasting

- Instant insights

Add Part-Time CFO for:

- Strategic financial advice (2-4 hrs/week)

- Board preparation (monthly)

- Fundraising strategy (quarterly)

- Complex modeling (as needed)

Cost:

- Financial OS: $0-500/month

- Part-time CFO: $2-4k/month

- Total: $24-48k/year vs $200 - 350k/year

Result: 90% of FP&A value at 15% of the cost

Real-World Comparison: Case Studies

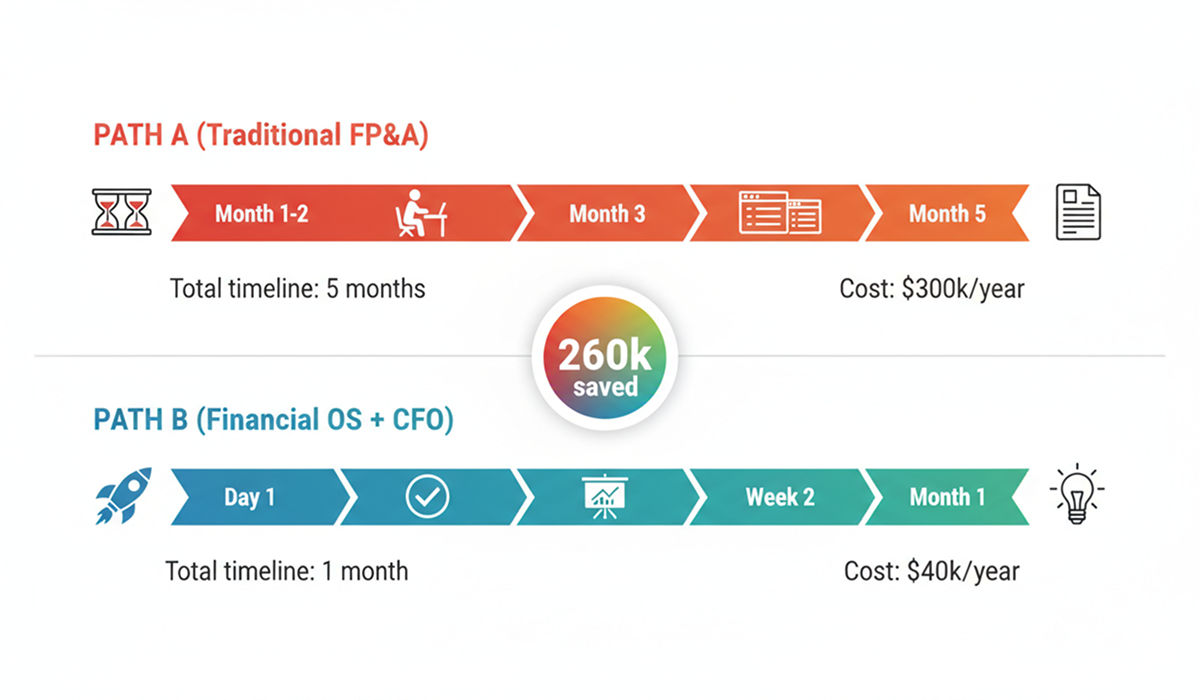

Case Study 1: Series A SaaS Company

Company Profile:

- $3M ARR

- 25 employees

- Just raised Series A

- Growing 15% MoM

Option A: Traditional FP&A

Hired:

- VP Finance: $160k + equity

- FP&A Analyst: $80k

- Total comp: $240k + benefits

Timeline:

- Month 1-2: Recruiting

- Month 3: Onboarding

- Month 4: Model building

- Month 5: First reports

Results:

- First insights at 5 months

- Monthly reports take 1 week

- Team of 2 fully occupied

- Annual cost: $300k+

Option B: Financial OS + Part-Time CFO

Implemented:

- Uniflow: $300/month

- Fractional CFO: $3k/month (8 hrs)

- Total: $3,300/month

Timeline:

- Day 1: Setup complete

- Week 1: Full operational

- Week 2: Board-ready reports

- Month 1: Strategic CFO advice

Results:

- Instant insights from day 1

- Real-time dashboards

- Strategic CFO guidance

- Annual cost: $40k

Savings: $260k/year (87% reduction)

Case Study 2: Pre-Seed Startup

Company Profile:

- $500k raised

- 5 employees

- 12 months runway

- Technical founder

Option A: Traditional Approach

Reality:

- Can't afford CFO

- Uses spreadsheets

- Spends 15 hrs/month

- Error-prone forecasts

- Missed cash flow crisis

- Ran out of money month 10

Outcome: Shutdown

Option B: Financial OS

Implemented:

- Uniflow Free plan: $0

- Setup time: 20 minutes

- Weekly reviews: 30 min

Results:

- Real-time runway tracking

- AI predicted cash crunch (month 6)

- Adjusted burn rate

- Started fundraising month 8

- Closed seed round month 11

Outcome: Thriving

Feature Deep-Dive: FP&A vs Financial OS

1. Cash Flow Management

Traditional FP&A:

- Monthly cash flow statements

- Manual reconciliation

- Historical analysis

- Static projections

- Reactive alerts

Financial OS:

- Real-time cash position

- Automatic reconciliation

- Predictive analysis

- Dynamic forecasting

- Proactive alerts

Winner: Financial OS ✅

Real-time data prevents cash crises

2. Financial Forecasting

Traditional FP&A:

- Excel-based models

- Manual assumptions

- Monthly updates

- Limited scenarios

- Expert required

Financial OS:

- AI-powered predictions

- Learning algorithms

- Continuous updates

- Unlimited scenarios

- No expertise needed

Winner: Financial OS ✅

AI outperforms manual forecasting by 20-30%

3. Scenario Planning

Traditional FP&A:

- Time-consuming to build

- Limited scenarios (2-3)

- Manual calculations

- Weeks to update

- Expert interpretation

Financial OS:

- Instant scenario creation

- Unlimited possibilities

- Automatic calculations

- Real-time updates

- Plain-English insights

Winner: Financial OS ✅

Speed enables better decision-making

4. Board Reporting

Traditional FP&A:

- Custom PowerPoint decks

- 3-5 days preparation

- Manual data compilation

- Static snapshots

- Professional polish

Financial OS:

- Template-based reports

- One-click generation

- Automatic data sync

- Real-time updates

- Professional design

Winner: Tie ⚖️

FP&A offers more customization, Financial OS offers speed

5. Strategic Advisory

Traditional FP&A:

- Experienced CFO insights

- Industry knowledge

- Strategic recommendations

- Board-level thinking

- Relationship building

Financial OS:

- AI-powered recommendations

- Data-driven insights

- Automated suggestions

- Best practice guidance

- Limited strategic depth

Winner: Traditional FP&A ✅

Human strategic thinking still valuable at scale

6. Cost Efficiency

Traditional FP&A:

- $200-350k/year minimum

- Additional hiring costs

- Training overhead

- Benefits packages

- Office space

Financial OS:

- $0-6k/year

- No hiring costs

- Instant learning

- No benefits needed

- Cloud-based

Winner: Financial OS ✅

97% cost reduction

Migration Strategy: FP&A to Financial OS

For Companies Considering the Switch:

Phase 1: Evaluation (Week 1-2)

- Audit current FP&A costs

- Assess actual value delivered

- Identify redundancies

- Calculate potential savings

Phase 2: Pilot (Week 3-6)

- Implement Financial OS alongside FP&A

- Run parallel processes

- Compare outputs

- Gather team feedback

Phase 3: Transition (Month 2-3)

- Shift daily operations to Financial OS

- Retain FP&A for strategic work

- Reduce FP&A headcount gradually

- Optimize hybrid model

Phase 4: Optimization (Month 4+)

- Full Financial OS adoption

- Part-time CFO for strategy

- Maximize cost savings

- Measure ROI

The Verdict: What's Right for Your Startup?

Choose Traditional FP&A if you:

- ✅ Have $100M+ revenue

- ✅ Are preparing for IPO

- ✅ Have complex entity structures

- ✅ Need deep strategic CFO

- ✅ Have budget for $300k+ annually

Verdict: <5% of startups

Choose Financial OS if you:

- ✅ Have <$50M revenue

- ✅ Are pre-Series C

- ✅ Want to optimize costs

- ✅ Need real-time insights

- ✅ Prefer automation

- ✅ Value speed

- ✅ Have limited finance expertise

Verdict: 95% of startups

Choose Hybrid if you:

- ✅ Have $10-50M revenue

- ✅ Are Series A-B stage

- ✅ Need strategic CFO advice

- ✅ Want operational efficiency

- ✅ Value both speed and depth

Verdict: Growing startups

Future of Startup Finance

The Trend is Clear:

2015-2020: Traditional FP&A dominates

- Hire CFO at Series A

- Build finance team

- Manual processes

2020-2023: Transition begins

- Fractional CFOs emerge

- First Financial OS platforms

- Hybrid models tested

2024-2026: Financial OS standard

- AI becomes table stakes

- Traditional FP&A for enterprise only

- Hybrid model for growth stage

2027+: AI-First Finance

- Autonomous financial management

- CFOs focus purely on strategy

- Real-time everything

Why This Matters:

Startups adopting Financial OS today have:

- Cost advantage: 85-95% savings

- Speed advantage: Real-time vs monthly

- Accuracy advantage: AI vs manual

- Scaling advantage: Automated growth

Early adopters win.

Conclusion: The Right Tool for the Right Stage

Traditional FP&A isn't bad—it's just overkill for most startups.

Think of it like transportation:

- Bicycle (Spreadsheets): Free but slow

- Car (Financial OS): Fast, affordable, efficient

- Private Jet (Traditional FP&A): Expensive, overkill for most

For 95% of startups, a Financial OS is the perfect vehicle.

You get:

- ✅ 90% of FP&A capabilities

- ✅ 5% of FP&A cost

- ✅ 10x FP&A speed

- ✅ Better accuracy

- ✅ Easier to use

When you need traditional FP&A ($100M+ revenue), you'll know—and can afford it.

Until then: Financial OS + part-time CFO = optimal setup.

Ready to modernize your startup finance? Try Uniflow's free AI-powered financial operating system. Get FP&A-level insights without the FP&A price tag.

Related Articles

- Financial Operating System 101: Complete Guide

- How AI Improves Financial Forecasting

- Uniflow vs Spreadsheets: Why Make the Switch

- Why Founders Fail at Financial Planning

Frequently Asked Questions

Q: Will a Financial OS replace my CFO?

A: No. It replaces manual FP&A work, freeing CFOs for strategic work. Think "CFO + Financial OS" not "CFO vs Financial OS."

Q: At what revenue should I hire a full-time CFO?

A: Generally $10-15M ARR for part-time, $25-50M ARR for full-time. But many companies delay longer with Financial OS + fractional support.

Q: Can Financial OS handle complex revenue models?

A: Yes. Modern Financial OS platforms handle subscription, usage-based, multi-currency, and complex revenue recognition.

Q: What about audit and compliance?

A: Financial OS provides audit trails and compliance reporting. For IPO-level requirements, add traditional FP&A support.

Q: How accurate is AI forecasting vs experienced CFO?

A: AI forecasting (85-95% accuracy) typically beats manual models (65-75%). But experienced CFOs add strategic context AI can't.

Q: Can I use both Financial OS and traditional FP&A?

A: Yes! Hybrid model is optimal for growth-stage: Financial OS for operations, strategic CFO for advisory.

Q: What if my investors expect traditional FP&A?

A: Modern investors prefer data-driven startups using best-in-class tools. Financial OS impresses investors more than traditional approaches.

Q: When should I transition from Financial OS to traditional FP&A?

A: When complexity justifies the cost—typically late Series C, pre-IPO, or $100M+ revenue. Most never need to.

Keywords: financial operating system vs FP&A, traditional FP&A, financial planning and analysis, financial OS for startups, CFO vs financial OS, startup financial management, FP&A alternative

About the Author: